Modigliani Miller These 2 : Capital Structure Theory Modigliani And Miller Mm Approach

The fundamental components of the workings of this theory are the absence of taxes and financial distress costs. Is an all-equity firm with 10 million shares outstanding.

Das Modigliani-Miller-Theorem basiert auf der Annahme eines.

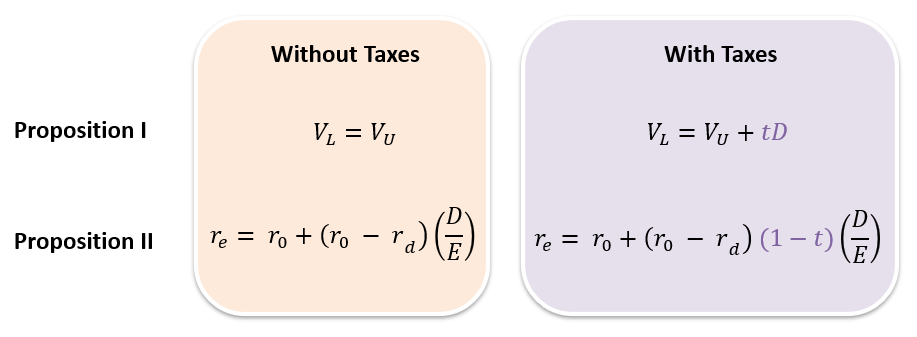

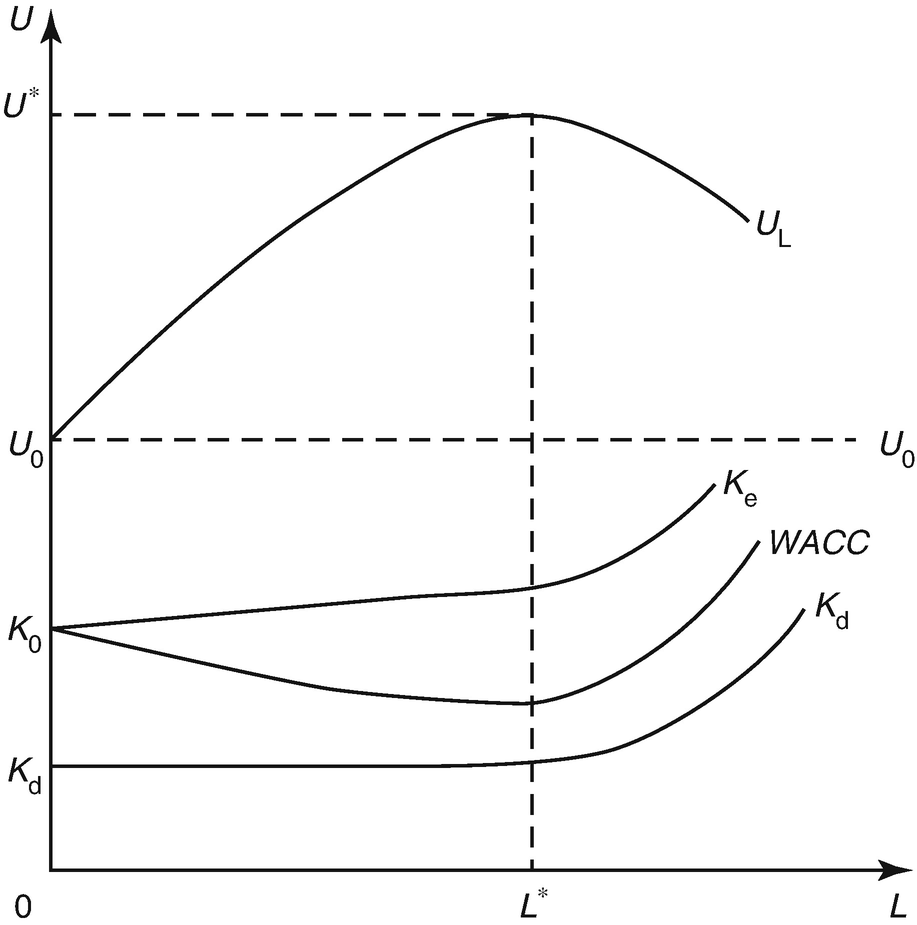

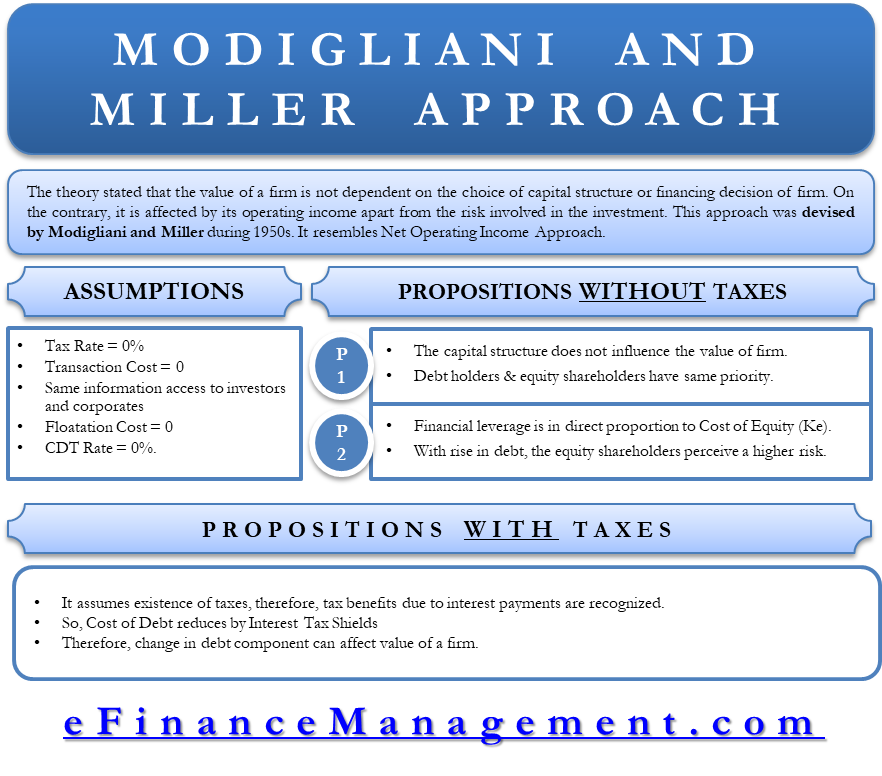

Modigliani miller these 2. Modigliani and Miller two professors in the 1950s studied capital-structure theory intensely. The theorem consists of two propositions which cover cases with and without taxes. Das Modigliani-Miller-Theorem zeigt nun gerade dass auf dem vollkommenen Kapitalmarkt im Gleichgewicht der Eigenkapitalkostensatz nicht einmal im Bereich sehr geringer Verschuldungsgrade annähernd konstant ist und hat insofern die traditionelle These abgelöst.

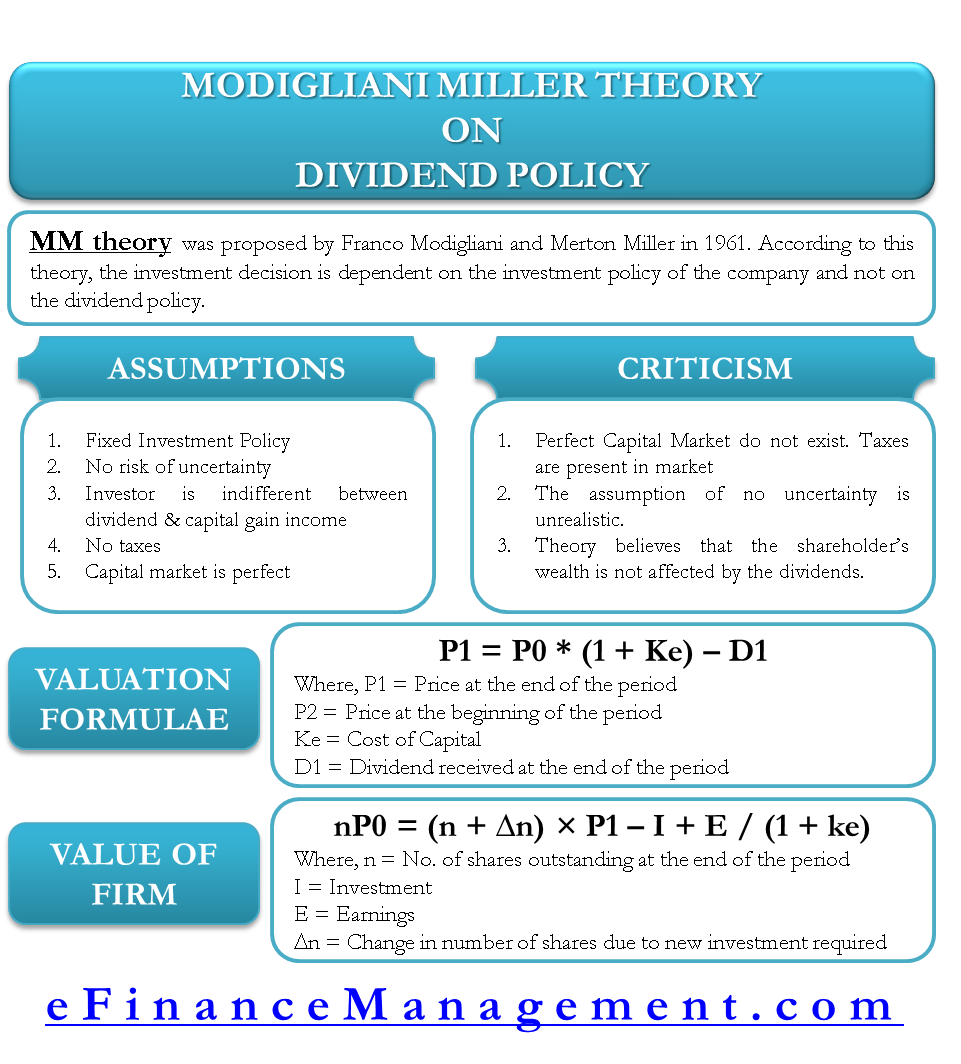

Financial Management MCQ on Capital Structure 1. The Modigliani-Miller model states that the payment of dividends is irrelevant to the market value of a company. Their first proposition was that the value of a company is independent of its capital structure.

Theories of Capital Structure Modigliani Miller Capital Structure Irrelevant Propositions MMs theory-- mkt value of any firm is independent of its capital structure -- 2 identical firm ม mkt value เทากน แม leverage ratio ตางกน Important of MMs 1. The Modigliani-Miller theorem is one of fundamental theories in corporate finance. Das Modigliani Miller - Grundmodell in einer Welt ohne Steuern Modigliani Miller.

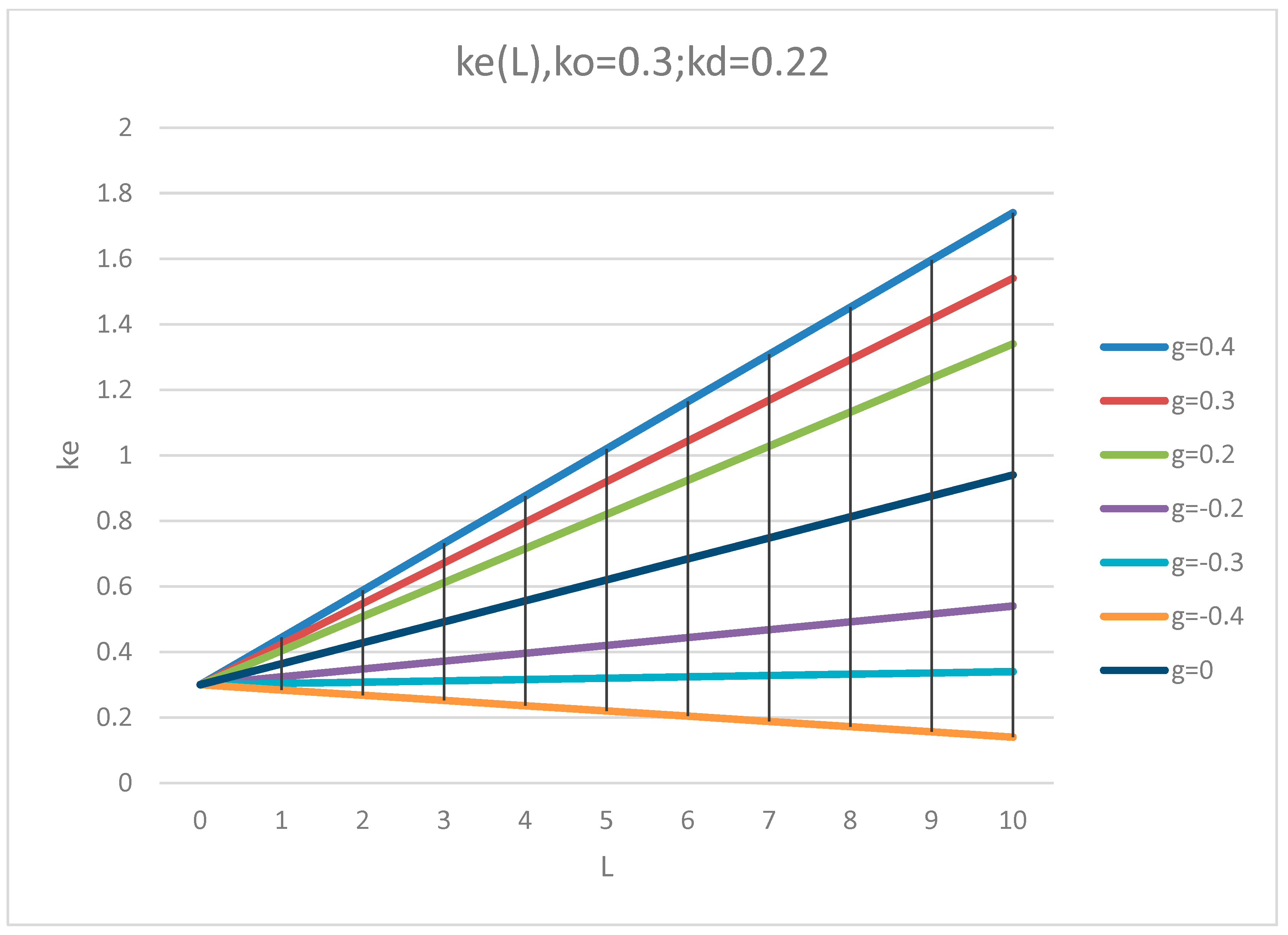

The Cost of Capital Corporation Finance and the Theory of Investment. Based on these 2 assumptions the capital. Their second proposition stated that the cost of equity for a leveraged firm is equal to the cost of equity for an unleveraged firm plus an added premium for financial risk.

August 2 2021 by Manturanjan Sa. Dividend one pays oneself to avoid risky stocks. According to Modigliani-Miller approach of relevance the value of the entity increases with debt because of.

The Modigliani-Millers Capital Structure Irrelevance Proposition theorem is the theory that suggests that a firms capital structure decisions hold no impact on its value. In between these 2 extremes are numerous papers which suggest that an optimum capital structure might involve a trade-off between positive tax subsidies associated with issuing debts and the various cost likely to be associated in an imperfect world with higher leverage De Angelo and Masulis 1980. Re-arrangement of the firms dividend stream as management needs.

Its only asset is 100 million cash invested in the risk-free asset which pays 10 per year. Modigliani and Miller made two findings under these conditions. Is an all-equity firm with 10 million shares outstanding.

A Stability b High earnings c Low risk d Tax deductibility of interest charges Ans- d Tax deductibility of interest charges 2. 261-297 1958 Erstes Theorem. Assume that the firms issues newshares and receive the proceeds of 50M from the operation.

If the company uses the excess cash and these proceeds to pay back all debt the share price changes to 40. Under the MM model on the. 2111 The Modigliani-Miller Theory with Taxes The essence of the initial MM Model proposed that under a perfect capital market with symmetry information and in the absence of taxes transaction cost and bankruptcy cost the market value of a firm is dependent on the capitalization of the firms expected return at a cost of unleveraged.

1 their article is one of the firsts to use modern theory of probability to analyze a financial problem ie. From their analysis they developed the capital-structure irrelevance proposition. Although Modigliani and Miller were not the first to apply arbitrage proof in finance Rubinstein 2003 their article allowed to popularize it for 2 reasons.

Homemade dividends are described by Modigliani and Miller to be the. False If the Modigliani-miller assumptions on payout policy are verified Shareholders are indifferent to a decrease of firms target payout ratio and a repurchase of shares today. It is embedded into the theoretical mainstream of the time.

Re-arrangement of the firms dividend stream by investors buying or. American Economic Review Vol. Assume a Modigliani-Miller MM world.

Essentially they hypothesized that in perfect markets it does not matter what capital structure a company uses to finance its operations.

Capital Structure Theory Modigliani And Miller Mm Approach Investing Post

The Modigliani Miller Propositions Cfa Frm And Actuarial Exams Study Notes

Modigliani Miller Theorem Youtube

Capital Structure Modigliani Miller Theory Springerlink

Modigliani Miller Theorem Wikipedia

Kapitalstrukturrisiko Und Arbitrageprozesse Die Modigliani Miller These Zur Optimalen Kapitalstruktur German Edition Ebook Heidrich Chris Sebastian Amazon Fr Boutique Kindle

Advanced Finance 2007 2008 Modigliani Miller Debt And

Modigliani Miller Theorem Youtube

The Modigliani Miller Scenario Tree Download Scientific Diagram

Capital Structure Modigliani Miller Theory Springerlink

Capital Structure Theory Modigliani And Miller Mm Approach

Mm Theory On Dividend Policy Focusing On Irrelevance Of Dividend

Modigliani Miller Theories Of Capital Structure Assumptions Formula Graph Example Criticism

Mathematics Free Full Text Generalization Of The Modigliani Miller Theory For The Case Of Variable Profit Html

Reproduced Figure 2 From Modigliani And Miller 1958 Download Scientific Diagram

5minutefinance Org Learn Finance Fast Modigliani And Miller Propositions

Https Www Utilepaper Com Download File File 06729538 733f 4383 Ad8f Be13c88654ba Pdf

2 Assumptions Of The Modigliani And Miller Chegg Com

Post a Comment

Post a Comment